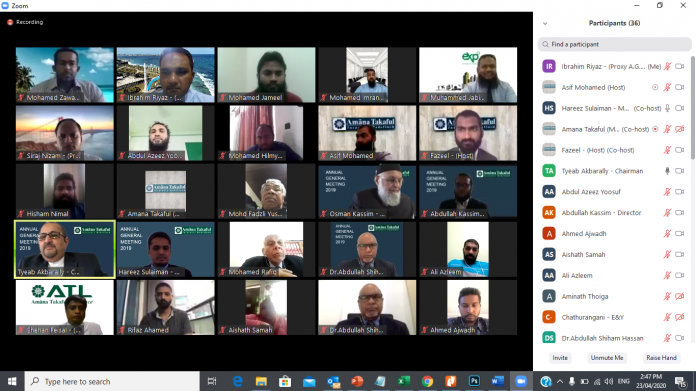

The only fully-fledged Shari’ah compliant insurance service provider, Amãna Takaful Maldives has conducted the ninth AGM on a virtual platform for the first time. Given the trying conditions arising from the global pandemic, Amãna Takaful decided to host this historical AGM virtually adhering to social distancing guidelines set out by the health authorities.

At the AGM held on 23rd day of April 2020, the board of directors has honoured the shareholder expectations with a final payment of dividends for the financial year ended in 2019.

The company has been registering consistent bottom-line results year on year and for the period under review, the PBT of the company recorded MVR 14.9 Million. Gross Written Premium, the key revenue indicator over-performed Industry growth by soaring to MVR 138 Million in 2019. Higher revenues coupled with prudent underwriting, efficient claims management restrained the costs, whilst judicious investment management translated into improved consolidated results.

Backed by rated Retakaful counter-parts, Amãna Takaful honoured settlement of claims amounted to MVR 66.2 Million in 2019, an increase of 39% over the previous year. Additionally, 2019 will also go down in the history of Amãna Takaful paying out larger claims with the least possible lead time in settlement of claims.

For the eighth consecutive year, Amãna Takaful declares dividends to its shareholders. In addition to the interim dividend payout in August 2019, a final dividend has now been approved at the AGM. “I am very pleased to announce that the Company has proved its determination, through its steady performance, despite the overall challenges faced by the Insurance industry as a whole. Based on the financial results of 2019, a total dividend of 10% will be distributed amongst our Shareholders, amounting to MVR 2.6 Million” said Chairman Tyeab Akbarally

The closure of the books for the purpose of dividend distribution shall be 16th April 2020. Shareholders in the register as of that date will be entitled to the dividends and other benefits.

He further commented “The results together with prudent management of the risk fund, enables the company to share a Surplus payout of 14% with our participants for the 7th consecutive year. Living true to the ideals of the Takaful concept, and espousing the values of ethical conduct, strengthens our resolve to provide a measure of certainty and stability to all our customers, be they individuals, entrepreneurs or corporates”.

Amãna Takaful Maldives as a responsible corporate, fervently observes the principles of mutuality and fair-play embedded in the Takaful system; adding value to all its stakeholders through a transparent system underpinned by the principles of Shari’ah. “As a versatile and innovative player in the market, we leveraged on the latest disruptive technology to scale up our front-end systems which enable customers to obtain solutions at a fraction of the time taken than before. To further enhance our responsiveness to the market needs, the ATM mobile App was also re-launched with the inclusion of new transactional capabilities and additional features to facilitate quick access and speedier service to the user.

A key priority to raise awareness regarding the principles of Islamic Finance and the Takaful concept itself continues unabated. Throughout 2019 we progressed our schedule of Takaful advocacy programs focusing on key target groups such as youth and young adults”. commented Managing Director Hareez Sulaiman.

Shareholders of Amãna Takaful Maldives have decided to re-elect Dr Abdullah Shiham Hassan as an Independent Director.

This year too, AGM was concluded with the decision to provide personal accident cover for all individual Shareholders – the message will be communicated in due course.

At this time of global health emergency, we condole the families who have lost their loved ones. On the same note, we also salute the healthcare professionals who are relentlessly working hard to curb and eliminate this unprecedented global pandemic.

The present directors of the company are Tyeab Akbarally (Chairman), Hareez Sulaiman (Managing Director) Osman Kassim, Dato Mohd Fadzli Yusuf, M.H.M Rafiq, Dr Abdullah Shiham Hassan and Abdullah Kassim.

Full details are available at the link below: